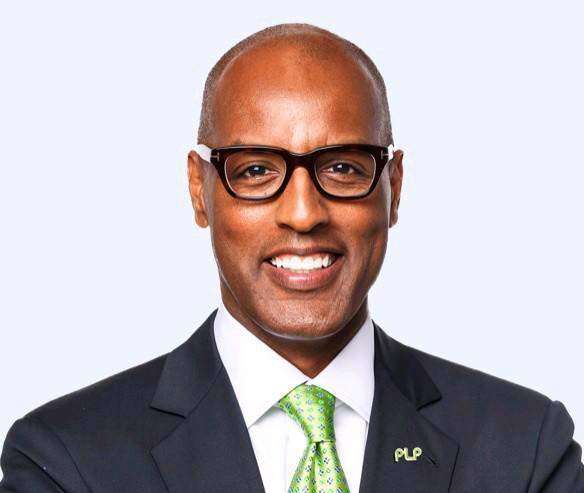

Our ExPo President, Cal Smith, advised our Committee members earlier today (4th February 2022) that the Minister of Finance, The Hon. Curtis Dickinson, would be addressing the House of Assembly this afternoon on the 2020 actuarial review of the contributory pensions scheme.

We were all ears! As all of our members receiving police pensions will no doubt be aware, there has been a freeze on our pensions, and those of all the civil service, for at least the last 8 years. This has been a serious concern not only to those of us who draw pensions, but also to present members of the Bermuda Police Service.

We last reported on this situation in an ExPo article we published in 2018 headed, “Continued freeze on police pensions?” CLICK HERE to read the article.

Later in the day the Royal Gazette published details of the report as presented to Parliament by Minister Curtis under the headline, "Retirement age could rise to 70 and contributions increase to brudge the funding gap"

The report read as follows:-

A massive shortfall in the Contributory Pension Fund could force the raising of the retirement age to 70 and increased payments into the scheme, the finance minister signalled today.

Curtis Dickinson told MP's that an actuarial review of the CPF’s performance between 2017-2020 had recommended major changes to stop it becoming “exhausted” in 2044 – three years earlier than predicted.

He said: “The CPF is the first pillar of retirement income and the benefits from this fund, together with other pensions, are important to the ongoing financial stability and security, as well as health, of the seniors in our society.

“Therefore, it is recognised that it is critical to ensure the long-term sustainability of this fund.”

Mr Dickinson added that the review called for contribution rates to increase at higher than four per cent a year more than benefit increases to get the fund back on track over the next few decades.

The review also backed an increase in the retirement age to 70 over a period of at least eight years.

The authors said a combination of the two – assuming that real rates of return remained steady – would extend the life of the fund past 2070.

Mr Dickinson said the number of contributors had declined from 35,889 in the year ending July 31 2017 to 34,629 in the year ending July 31 2020.

He added: “The contributory pension scheme plays an important role in Bermuda’s pension arrangements, providing a first tier or basic pension to more than 10,960 seniors and other beneficiaries, the majority of whom live in Bermuda.

“There are also disability pensions, and non-contributory benefits.

“The maximum benefit is currently about $1,500 per month. Altogether, some 14,050 persons currently receive benefits under the Act.”

He added: “The financial position of the fund over the three years was below expectations, mainly due to lower than expected contribution income.

“The viability of the fund in the short to medium term has decreased with the fund being able to cover at least 10.5 years of the current expenditure and being positive for the next 24 years.

“This compares to 11 years and 29 years respectively from the last valuation.”

Mr Dickinson added that, like other countries, Bermuda faced the problem of an ageing population.

He said that changes to pension contributions and benefits could be made after consideration by the Pension Reform Committee.

He added that net assets of the CPF grew two per cent over the three years considered from $1.93 billion to $1.97 billion – seven per cent below the projected figure.

Mr Dickinson said: “It should be noted that the funding policy for the fund is not based on full actuarial funding, but based on sustainable funding.”

He added that to “improve the projected financial position of the fund in the long term the ministry will carefully consider alternate scenarios included in the report, in conjunction with the recommendations of Pension Reform Committee”.

Mr Dickinson said: “We are very sensitive to the challenges faced by our seniors and the ongoing struggles of many of our businesses.”

EDITORS NOTE - There is no question there is what has been described as "a massive shortfall in the Contributory Pension Fund" and that it is, in the Minister's words, "critical to ensure the long-term sustainability of this fund.” At this point no definite changes are being confirmed but it would seem most unlikely that we can expect any kind of raise in our pensions in the near future. We will keep you informed of any further developments in this regard.

We had previously published an article entitled "Continued cost of living freeze on pensions" in 2017 (CLICK HERE to view it) in which Iain Morrison kindly provided us with the following additional information about the freeze on Government pensions:-

“Before the freeze, the cost of living increases were reviewed every second year, on even years. We were last awarded a cost of living increase in 2012, which, I believe amounted to a 5% increase. The Government introduced the 'freeze' in 2014, just as it was due to be reviewed again - i.e. the next even year after 2012. Obviously, it is next due for review in 2018. So, we have currently missed TWO potential increases (2014 & 2016) and if we are lucky enough to have the freeze lifted, and get some sort of increase in 2018, it will be the first one for SIX years.”

5th February 2022

We have also received the following comments from Moby Pett:-

I believe the Contributory Pension Fund is the State old age pension which had a small increase a couple of years ago. The Police pension comes from the Public Service Superannuation Fund which had its last increase in 2012 for the two years up to 30th June 2012. We have not had an increase in almost 10 years.

Moby